Federal Reserve Changes Rules for Loans Aimed at Small Business Owners

Big News Network.com

19 Nov 2020, 14:59 GMT+10

Capital is the lifeblood of any small business. The coronavirus Pandemic was an unprecedented systemic shock that crippled millions of small-scale entrepreneurs. As economic trends look up, the focus is on how to get such businesses back to their feet.

The Federal Reserve has had a concerted effort to inject liquidity into the economy. Businesses have to do their fair share in researching what loans they are eligible for, and how much is that is the case. It is prudent for a small business owner to write a business plan before applying for a small business loan. This way, it can be easier to take the necessary steps in getting one.

Recently, the Federal Reserve lowered the barriers to its lending program for smaller businesses as part of its Main Street Lending Program. This program is surprisingly underutilized, given how much of a hit the Pandemic took on small businesses.

Reduction of Minimum for Loans

The Federal Reserve announced its decision to lower the minimum loan size from $250,000 to $100,000 and also reduce fees on those loans. Banks had been on the line to issue loans but many businesses felt that these loans were not readily available to them.

This is part of a wider effort to continue to keep main street recovery at the pace it is going. In the last quarter, the US GDP expanded by a historic 32 percent.

President Trump, who is never shy to talk up the economy, used this as part of his closing argument for the 2020 election campaigns. The extent to which his policies contribute to the growth is subject to debate, but its usefulness to him politically has never been in doubt. Mitch McConnell, the Senate Majority leader before the election, offered not to continue with stimulus negotiations in favor of confirming a Supreme Court nominee.

The reduction in the minimum loan application comes with the easing of some restrictions on debt for companies already participating in the Program. Reducing the minimum amount to $100,000 should expand the number of businesses willing to take up these loans. Small to medium-size enterprises are essential to the economy. Companies with less than $2 million in loans already can have that exempted in the new computation.

Banks are hesitant to lend to businesses that may struggle. The new cover by the Fed will give banks wiggle room with businesses that have uncertainty but were doing well before the Pandemic hit.

Already, the PPP program has issued loans totaling about $3.7 billion. However, this is modest given the fact that the capacity of the program is well into the hundreds of billions, once the $75 billion in collateral from the Treasury Department that can be leveraged up is factored in.

In total, the Main Street Lending Program has disbursed loans to only about 400 businesses that took up an average of $9 million in debt. The Main Street program loans have to be repaid, unlike the Congressional Paycheck Protection Programme where the loans can be forgiven if it mostly goes into keeping employees on the payroll. This could be an explanation as to why PPP loans proved more popular.

The lowering of the floor for support will be a lifeline for many small businesses. Small and medium enterprises' growth is going to be vital for the economy to rebound back to pre-Covid levels. The collateral effect is improved employment statistics because a lot of these businesses had to let some employees go at the height of the shutdowns.

The Significance of These Changes

These measures are an extension of the steps the Fed took in March to inject liquidity into the economy. Some borrowers had complained that the conditions that came with the loans were unfavorable. This made the Main street loans have less desirability than what the Federal Reserve and the Treasury anticipated.

The adjusting of debt exemptions will encourage further taking of these loans. Additionally, the Fed will adjust fees to make these loans more palatable.

All these come at a time of historically low interest rates. Businesses, therefore, have a window to take up manageable debt and use it to boost their operations.

It is difficult to gauge the direction of the Coronavirus. The world seems to be in the middle of a new wave, and governments are implementing lockdown measures of differing severity. However, it is unlikely that the USA will resort to full shutdowns as it was in March.

After the election, all eyes will be on the US Congress to see whether the leadership will take up new stimulus talks in the lame-duck session. The Fed has urged Congress to pass more stimulus measures. This will hopefully be possible once the contentious election is fully resolved.

The Federal Reserve has also bought some corporate debt. This is part of the Fed's commitment to support the economy to the maximum extent possible. The loans are a vital part of this effort.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Manufacturing Mirror news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Manufacturing Mirror.

More InformationSmall Business

Section"One Nation, One Election will strengthen democracy, save resources": Tripura CM Saha

Agartala (Tripura) [India], February 26 (ANI): Tripura Chief Minister Manik Saha on Wednesday said that the 'One Nation, One Election'...

CM Pushkar Dhami wishes peace, prosperity for state on Maha Shivratri

Khatima (Uttarakhand) [India], February 26 (ANI): Uttarakhand Chief Minister Pushkar Singh Dhami, along with his wife, on Wednesday,...

Romanian Ex-Presidential Candidate Arrested for Extremism

Former Romanian presidential candidate Calin Georgescu has been arrested on charges of spreading fascist ideology and participating...

ED arrests Gujarat-based journalist Mahesh Langa in money laundering case

New Delhi [India], February 25 (ANI): The Enforcement Directorate (ED) has arrested Gujarat-based journalist Mahesh Langa in a money...

Pakistan actor's son confesses to drug trafficking

Karachi [Pakistan], February 25 (ANI): Sahir Hasan, the son of renowned Pakistani actor Sajid Hasan, has confessed to being involved...

Musk reiterates support for AfD

The right-wing party has recorded its best-ever result in Germany's parliamentary elections, preliminary results show ...

Automotive

SectionVolkswagen partners with CATL to boost China EV expansion

WOLFSBURG, Germany: Volkswagen is strengthening its push into China's electric vehicle (EV) sector by partnering with CATL, the world's...

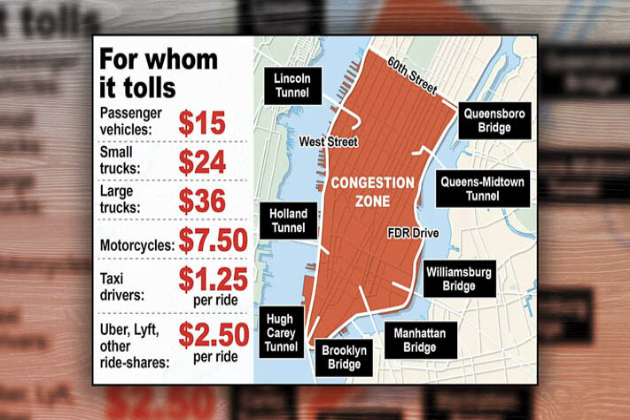

NY Governor defends Manhattan congestion toll in meeting with Trump

NEW YORK CITY, New York: Governor Kathy Hochul met with President Donald Trump in the Oval Office to defend Manhattan's congestion...

Foxconn seeks Honda as a partner, eyes ties with Nissan, Mitsubishi

TOKYO, Japan: Foxconn has approached Honda Motor with a proposal to form a partnership, aiming to establish a broader collaboration...

China greenlights 13 foreign firms for pilot value-added telecom services

BEIJING, March 1 (Xinhua) -- In a significant move to open its telecommunication sector further, China has approved 13 foreign-invested...

Creighton, Xavier climbing at the right time

(Photo credit: Steven Branscombe-Imagn Images) Big East tournament seeds and NCAA Tournament positioning are on the line when Creighton...

US tariff hike on vehicle imports could impact Nigeria's auto market

ABUJA, NIGERIA — For longtime automotive importer David Tope, Nigeria's auto market has become increasingly difficult. He used to...