Asian markets mostly up but optimism tempered by inflation fear

News24

23 Feb 2021, 14:12 GMT+10

- Asian markets mostly rose Tuesday, fuelled by growing hope that vaccine rollouts will allow the global economy to get back on track.

- Observers are predicting a surge in economic activity from the middle of the year as lockdowns are eased.

- The play-off between recovery and inflation worries has brought a rally in world markets to a halt in recent weeks, after some had hit record or multi-year highs.

Asian markets mostly rose Tuesday, fuelled by growing hope that vaccine rollouts will allow the global economy to get back on track, but the optimism was tempered by niggling worries that the recovery will fan inflation and interest rate hikes.

With governments picking up the pace in their coronavirus inoculation drives, and infection and death rates slowing in most parts of the world, observers are predicting a surge in economic activity from the middle of the year as lockdowns are eased.

Added to that is Joe US President Biden's huge growth-boosting spending programme, which is likely to be passed by Congress next month, on top of the Federal Reserve's pledge to keep monetary policy ultra-loose for as long as needed.

Monumental government and central bank support worth trillions of dollars has been a key driver of the surge in world equities from their nadir almost a year ago when the coronavirus was rampaging across the planet.

But while the mood is increasingly good, investors are turning their focus to the impact of the reflation -- a rally in prices as people go back to shops and restaurants or start going on holiday again.

Expectations that inflation will spike has seen US 10-year Treasury yields rally to a one-year high, and that has spooked investors who fear that means interest rates will go up in turn.

Technology firms, which have outperformed as they benefit from people being forced to stay home, have been worst hit, while those likely to do well as economies reopen are enjoying much-needed buying interest.

"Investors are quickly rediscovering that not all stocks are created equal in a Covid recovery as expensive tech names (are sold) to provide the source of funds for less expensive travel-related markers, along with energy and other inflation beneficiaries," said Axi strategist Stephen Innes.

The play-off between recovery and inflation worries has brought a rally in world markets to a halt in recent weeks, after some had hit record or multi-year highs.

'Blase' Fed concern

The tech-rich Nasdaq tumbled more than two percent Monday, while the S&P 500 was also in the red, though the Dow eked out gains.

And Asian investors trod warily. Hong Kong, Sydney, Singapore, Taipei, Manila, Mumbai, Bangkok and Jakarta were all up but Shanghai, Seoul and Wellington fell. Tokyo was closed for a holiday.

Crucial catalysts to drive stocks higher "may be fading as markets come to terms with the next phase of the recovery", said Chris Iggo at AXA Investment Managers.

"I wouldn't be surprised if market returns are more volatile in the coming months."

Traders are keenly awaiting Fed boss Jerome Powell's congressional testimony from Tuesday, looking for an idea about the central bank's thinking on the rising yields and their effect on policy, particularly interest rates.

"The Fed has gone to great lengths to dial back expectations of any possible near term rate rise, giving the impression that they will ignore any short-term inflationary spikes," said CMC Markets' Michael Hewson.

"With US 10-year yields falling just shy of 1.4%... there is a concern that US central bankers are being a little bit too blase about inflation risks", particularly with a new US stimulus close.

But OANDA's Edward Moya said Powell will likely reaffirm his commitment to seeing employment recover and inflation remain elevated.

"The path of rates won't change this year, with the earliest that some economists see a potential move up in rates being next January," he said.

"Since financial conditions are tightening and with wage pressures remaining nonexistent, that should keep inflation fears from getting out of control.

"The economic data has been improving but remains inconsistent and that is all Powell needs to keep his ultra-accommodative stance."

Oil prices continued their march higher, piling on more than one percent a day after clocking up gains of almost four percent, on demand optimism as the world emerges from lockdown.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Manufacturing Mirror news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Manufacturing Mirror.

More InformationSmall Business

Section"State govt has failed to provide security to public": Bihar Congress chief Rajesh Kumar

New Delhi [India], July 14 (ANI): Bihar Congress President Rajesh Kumar on Monday heavily criticiSed the NDA-led Bihar government over...

CM Mohan Yadav woos global investors for Madhya Pradesh in UAE

Dubai [UAE], July 14 (ANI): Madhya Pradesh Chief Minister Mohan Yadav, currently on an official visit to the UAE as part of the MP...

"Criminals have become 'samratth' in Bihar, they have won": Tejashwi Yadav questions PM Modi's silence on deteriorating law and order

Patna (Bihar) [India], July 14 (ANI): Rashtriya Janata Dal (RJD) leader Tejashwi Yadav on Monday alleged that the Bihar government...

"MP is committed to increasing religious tourism": CM Mohan Yadav during Dubai visit

Dubai [UAE], July 14 (ANI): Madhya Pradesh Chief Minister Mohan Yadav, currently on an official visit to the UAE as part of the MP...

"Investors in large numbers have expressed desire to invest in Madhya Pradesh": CM Mohan Yadav in Dubai

Dubai [UAE], July 14 (ANI): Madhya Pradesh Chief Minister Mohan Yadav on Monday said that a committee of Indian businessmen has taken...

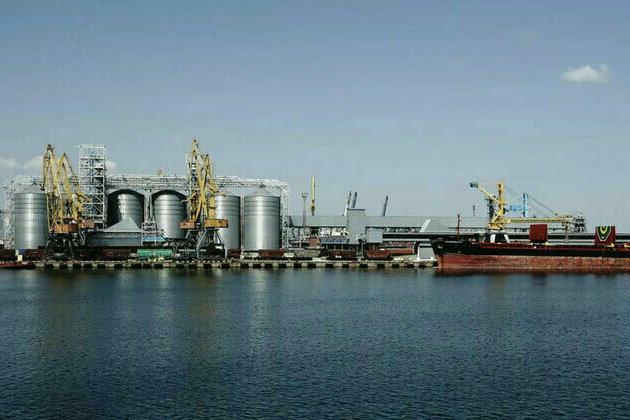

US investors take over key Ukrainian Black Sea grain hub FT

Two American funds have gained control of Olimpex terminal after winning a loan fraud case against the previous owners US investors...

Automotive

SectionUAE: CM Mohan Yadav attends 'Madhya Pradesh Business Investment Forum' Program

Dubai [UAE], July 14 (ANI): Madhya Pradesh Chief Minister Dr Mohan Yadav attended the 'Madhya Pradesh Business Investment Forum Program'...

Logistics, supply chain infrastructure, foreign investment feature as key avenues of discussion during MP CM Yadav's UAE visit

Dubai [UAE], July 14 (ANI): Madhya Pradesh Chief Minister Dr Mohan Yadav held wideranging interactions with industry experts for bringing...

India moving forward with US Bilateral Trade Agreement, says govt official

New Delhi [India], July 14 (ANI): India is making concrete progress toward finalising a Bilateral Trade Agreement (BTA) with the United...

India on course to become world's 4th largest economy, surpassing Japan amid looming US tariffs: Rubix Report

New Delhi [India], July 14 (ANI): India is on track to become the world's fourth-largest economy in 2025, surpassing Japan, marking...

Indian team arrives in US to resume negotiations for trade agreement

Washington DC [US], July 14 (ANI): A high-level team from India's Commerce and Industry Ministry has arrived in Washington DC, to take...

Update: China's new energy vehicle registrations hit record 5.62 mln in H1 2025

BEIJING, July 14 (Xinhua) -- China registered a record 5.62 million new energy vehicles (NEVs) in the first half of 2025, marking a...