Market outlook: Investors to watch FII flows, auto data, US economic Indicators for rate cut clues

ANI

23 Feb 2025, 12:16 GMT+10

Mumbai (Maharashtra) [India], February 23 (ANI): Domestic stock markets are expected to closely monitor foreign institutional investor (FII) flows, sectoral insights from auto sales data, banking performance, updates on US tariff policies, and US Personal Consumption Expenditures (PCE) inflation data, as these factors could influence expectations regarding the US Fed's rate cut timeline, according to market observers.

Market experts say that key macro indicators like GDP growth data for the third quarter (Q3) Financial Year (FY25) and fiscal deficit numbers will provide insights into momentum of the Indian economy.

'The upcoming holiday-shortened week is expected to remain volatile due to the expiry of February's derivative contracts. Additionally, trends in foreign institutional investor (FII) flows and updates on U.S. tariff policies will be closely watched,' said Ajit Mishra - SVP, Research, Religare Broking Ltd.

On the domestic front, the monthly F&O expiry on February 27 could cause short-term volatility, according to the Bajaj Broking Research Team.

'From February 24 to 28, 2025, Investors will closely monitor the US PCE inflation data, which could shape expectations around the US Fed's rate cut timeline, impacting global liquidity flows. On the domestic front, the monthly F&O expiry on February 27 may lead to short-term volatility, while key macro indicators like GDP growth data for Q3 FY25 and fiscal deficit numbers will provide insights into economic momentum,' the Bajaj Broking Research Team added in its outlook commentary.

In the previous trading sessions, markets traded within a tight range and ended nearly half a per cent lower, extending the ongoing corrective phase.

With no major domestic events, the persistent foreign fund outflows and comments from the U.S. President on potential tariffs kept market sentiment subdued throughout the week.

While select pockets showed resilience, they failed to drive a meaningful recovery. As a result, both benchmark indices, Nifty and Sensex, closed near their weekly lows at 22,795.90 and 73,311.06, respectively.

On the sectoral front, a mixed trend kept participants engaged. Metals, energy, and realty outperformed, while auto, pharma, and FMCG were the top laggards. Meanwhile, broader indices--midcap and smallcap--rebounded by approximately 1.5 per cent each after a sharp decline, providing some relief.

On the benchmark front, a decisive break below 22,700 in Nifty could trigger the next leg of the downtrend, potentially dragging the index to 22,500 and then 22,000.

On the upside, a recovery would first face resistance at 23,150 (20-DEMA), and a breakout above this level could extend gains towards the next major hurdle at 23,600 (200-DEMA). (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Manufacturing Mirror news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Manufacturing Mirror.

More InformationSmall Business

SectionNepal: Pro-monarchy protestors clash with police in Kathmandu

Kathmandu [Nepal], March 28 (ANI): Violence broke out in Kathmandu on Friday after protesters calling for the restoration of monarchy...

Hyderabad Police arrests three for digital arrest fraud case

Hyderabad (Telangana) [India], March 28 (ANI): In a significant breakthrough, the Hyderabad Cybercrime Police have arrested three individuals...

PM Modi on "boosting trade" with Belgium King

New Delhi [India], March 27 (ANI): Prime Minister Narendra Modi on Thursday spoke to King Philippe of Belgium, where he discussed the...

Will this scandal be the end of unsinkable Netanyahu

Revelations of high-ranking Israeli officials shady connections to Qatar open a new front in the PM and his allies fight to retain...

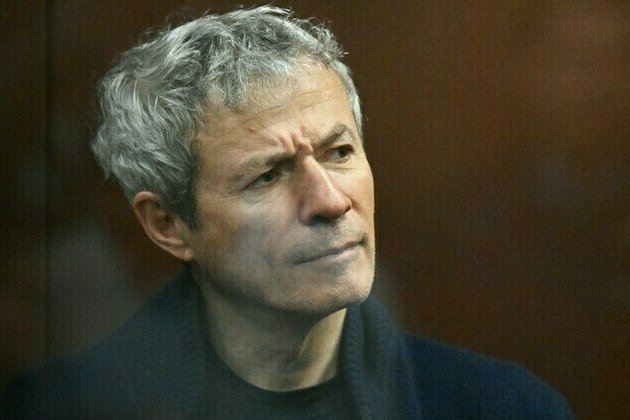

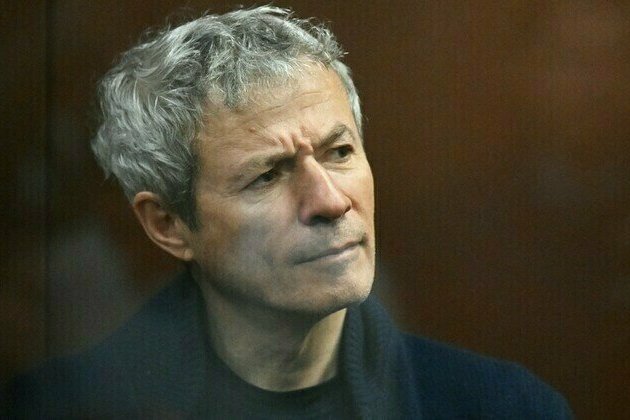

Forbes-listed billionaire arrested in Moscow

The founder of agricultural major Rusagro, Vadim Moshkovich, has been placed in two-month pre-trial detention over fraud allegations...

Forbes-listed billionaire charged with fraud

The founder of agricultural major Rusagro, Vadim Moshkovich, has been placed in pre-trial detention Russian prosecutors have detained...

Automotive

SectionAutomakers lead U.S. stock markets lower after tariff hit

NEW YORK, New York - Shares in automakers fell sharply Thursday after U.S.President Donald Trump imposed a 25 percent tariff on all...

Ford F-150 under investigation for transmission defects

WASHINGTON, D.C.: Federal safety regulators have launched a new investigation into Ford's best-selling F-150 pickup trucks after receiving...

Hyundai to invest $20 billion in US, build steel plant in Louisiana

WASHINGTON, D.C.:/SEOUL: Hyundai Motor Group is set to dramatically expand its U.S. footprint, with a US$20 billion investment that...

TATA.ev and Allied Motors launch electric vehicle portfolio in Mauritius

New Delhi [India], March 28 (ANI): TATA.ev, India's largest four-wheeler electric vehicle manufacturer and a subsidiary of Tata Motors,...

Economic Watch: U.S. auto tariffs ignite market turmoil, transatlantic trade tensions

U.S. President Donald Trump attends an event celebrating the Greek Independence Day at the White House in Washington, D.C., the United...

Hyundai Motor India debuts in NIFTY Next 50, NIFTY 100, NIFTY 500, S&P BSE 500 and other key capital market indices

Gurugram (Haryana) [India], March 28 (ANI): Hyundai Motor India Limited (HMIL) (NSE: HYUNDAI, BSE: 544274) has marked a significant...