Indian markets closed at highest level of 2025, Sensex closes at 82,755 and Nifty at 25,245

ANI

25 Jun 2025, 17:51 GMT+10

New Delhi [India] June 25 (ANI): India's equity benchmarks closed the day on a high note, marking its highest closing level in 2025, fuelled by 'easing geopolitical tensions' in the Middle East region.At the end of the trading session on Wednesday, BSE Sensex settled at 82,755.51, adding 700.40 points or 0.85 per cent, while Nifty 50 at National Stock Exchange (NSE) was up 200.40 points or 0.80 per cent at 25,244.75. Experts say market sentiment comes from easing geo-political tensions.

'Indian equity markets have staged a recovery, supported by easing geopolitical tensions in the Middle East and a moderation in crude oil prices,' said Vinod Nair, Head of Research, Geojit Investments Limited.From a sectoral perspective, Nifty Media stood out as the top gainer for the day, followed by Nifty IT and the Nifty mid and small Healthcare sector. On the other hand, Nifty Private Bank registered a slight decline for the day. 'Large-cap stocks, especially in IT and auto, are outperforming, aided by a strong dollar and improved risk appetite. Domestically, a favourable monsoon forecast, and moderating inflation are further underpinning the optimism,' Vinod Nair further added.On Wednesday, out of 2,990 stocks, 2,135 stocks traded upwards, while 776 stocks went downwards and only 79 stocks were unchanged for the day.Rupak De, Senior Technical Analyst at LKP Securities noted, 'The Nifty remained highly volatile as updates from the Middle East crisis zone impacted Indian equities. However, the overall sentiment remains positive, with a possibility of a rise towards 25,350. Immediate support is placed at 25,000; a break below this level could lead to a drift towards 24,850. On the other hand, if the index holds above 25,000, strength may persist, and the sentiment could favour long traders.'Shrikant Chouhan, Head Equity Research, Kotak Securities, noted, 'Technically, after a gap-up open, the market held its positive momentum throughout the day. A bullish candle on daily charts and an uptrend continuation formation on intraday charts indicate a further uptrend from the current levels.'Defence stocks were the top loser of the day, down 2 per cent. But most of the sectoral indices ended in green with auto, consumer durables, IT, telecom, healthcare and media up between one to two per cent. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Manufacturing Mirror news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Manufacturing Mirror.

More InformationSmall Business

SectionProtomont Expands FILAMONT 3D Printer Filament and Resin Range

SMPL New Delhi [India], June 25: Protomont Technologies LLP offers a comprehensive range of additive manufacturing solutions in India....

NAVYA skilling initiative marks milestone in our shared mission to empower adolescent girls: MoS Savitri Thakur

Sonbhadra (Uttar Pradesh) [India], June 25 (ANI): In a significant step towards empowering young girls and furthering the vision of...

Imprisoned Russian businessman slams Armenian government

Samvel Karapetyan has been arrested after siding with the Armenian Apostolic Church against the countrys leadership Armenia's leadership...

ECO FAWN CEO raises voice at 59th UNHRC against Pahalgam terror attack, urges global solidarity

Geneva [Switzerland], June 24 (ANI): In a video intervention at the 59th session of the United Nations Human Rights Council (UNHRC)...

Romil Vohra had been wanted for multiple crimes: Delhi Police after encounter

New Delhi [India], June 24 (ANI): Detailing the encounter between Delhi Police and wanted criminal Romil Vohra, Additional CP (Special...

UK plan to cut energy bills for industrial firms threatens to leave small businesses out in the cold

The UK government aims to cut energy bills for large businesses by up to a quarter over four years, thanks to a Pound 2 billion investment...

Automotive

SectionToyota hikes US auto prices, says move is not tariff-driven

PLANO, Texas: Toyota Motor will raise prices across a range of vehicles in the United States starting next month, the Japanese automaker...

Markets rally on hopes Iran won’t disrupt oil flow

NEW YORK CITY, New York: U.S. stocks went up and oil prices fell this week as investors hoped that Iran would not block the global...

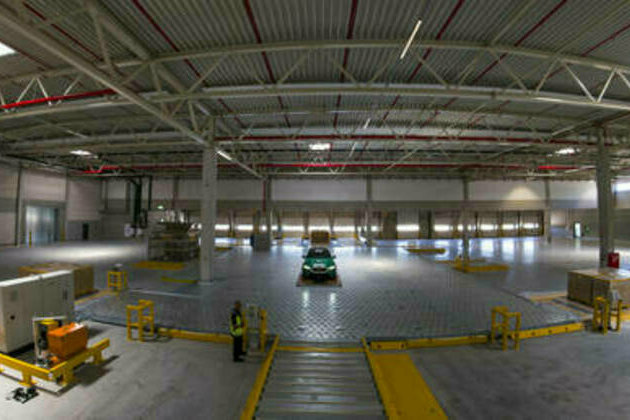

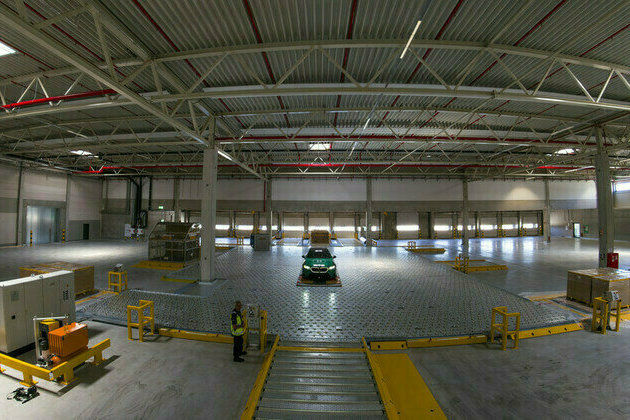

Amazon’s Zoox unveils plan to build 10,000 robotaxis a year

HAYWARD, California: In a significant step toward its commercial debut, Amazon-owned Zoox has unveiled its first factory dedicated...

US consumers cut back after early surge ahead of Trump tariffs

WASHINGTON, D.C.: Retail sales dropped sharply in May as consumer spending slowed after a strong start to the year, primarily due to...

German export outlook slips on trade fears - survey

Automakers and chemical firms report sharp declines in sentiment amid ongoing trade uncertainty, according to Ifo ...

German export outlook slips on trade fears survey

Automakers and chemical firms report sharp declines in sentiment amid ongoing trade uncertainty, according to Ifo Expectations have...