FY26 poised for decent growth amid falling inflation and monetary policy shift: Report

ANI

27 Jun 2025, 12:39 GMT+10

New Delhi [India], June 27 (ANI): A significant drop in inflation, a healthy crop outlook, a normal monsoon, and changes in monetary policy have created a positive outlook for FY26 across sectors such as automobiles, consumer durables, FMCG, and building materials, noted a report by Centrum. The Indian automobile industry is set for moderate yet broad-based growth in FY26, underpinned by supportive macros, policy reforms, and a healthy product pipeline. The Passenger Vehicle (PV) segment is expected to grow at 2-4 per cent, buoyed by continued SUV demand and improved affordability. The Commercial Vehicle sector is also likely to expand by 5-6 per cent.Additionally, Household consumption is also likely to continue its uptrend in FY26, mainly due to the positive rural economy supported by cooling commodity prices. 'Going forward, the income tax cuts, forecasts of a normal monsoon, cut in interest rates and healthy capex by income tax cuts, forecasts of a normal monsoon, cut in interest rates and healthy capex by the government is likely to lift the consumer sentiments and will likely lead to improve the overall consumption story of India,' Centrum said in the report.The forecast for the agriculture sector so far in FY26 is favourable will add impetus to the rural economy. The rabi harvest in March-April 2025 was strong, notably for wheat and other staples, which improved farm incomes in many regions. This has already translated into higher spending on farm equipment and inputs.Furthermore, the southwest monsoon in 2026 is predicted to be above normal. The government has also announced a 3 per cent increase in MSP (Maximum Selling Price) for Kharif crops in June, ensuring price support for crops like rice, maize, and pulses.On the banking side, credit expansion has shown signs that loan growth is stabilising and could rebound in FY26, following a marked slowdown in credit expansion through FY25. The positive outlook can be attributed to interest rates coming down and economic activity picking up, credit demand from banks and non-banking financial companies (NBFCs) is likely to strengthen. However, going forward the report cautions to watch for monsoon progression and fuel prices 'Key monitorables include monsoon progression, fuel prices, and credit availability, which will shape demand resilience through FY26'. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Manufacturing Mirror news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Manufacturing Mirror.

More InformationSmall Business

SectionHead Constable of Delhi Police suffers from chest pain after being caught red-handed while taking bribe

New Delhi [India], June 30 (ANI): A Head Constable of Delhi Police, currently under treatment at Burari Hospital, suffered chest pain...

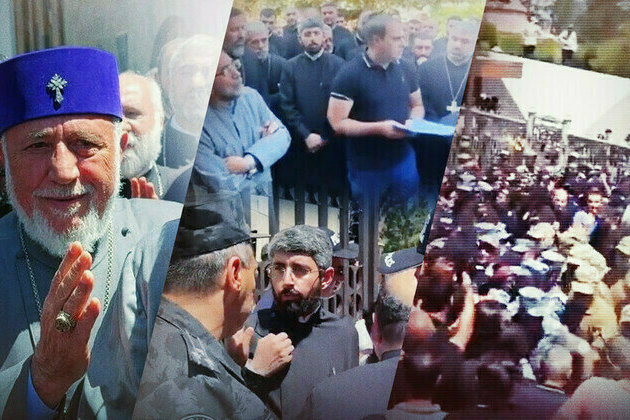

Why the next revolution in this country might start in a cathedral

Armenias ancient church finds itself at the center of a political storm as the government cracks down on dissent within its ranks ...

Madhya Pradesh CM holds roadshow in Surat, secures Rs 15,710 cr investment proposals

Surat (Gujarat) [India], June 29 (ANI): Madhya Pradesh Chief Minister Mohan Yadav on Sunday held a roadshow in Gujarat's Surat, aimed...

Kremlin weighs in on unrest in Armenia

The former Soviet republic has arrested several clerics amid a stand-off with the opposition ...

UP: CM Yogi Adityanath pays tribute to philanthropist, Bhamashah; honors top tax-paying traders

Lucknow (Uttar Pradesh) [India], June 28 (ANI): Chief Minister Yogi Adityanath paid tribute to philanthropist and businessman Bhamashah...

WANotifier Joins TinySeed EMEA Fall 2024 Batch to Help Businesses Market at Scale on WhatsApp

SMPL Dover (Delaware) [US]/ Pune (Maharashtra) [India], June 28: WANotifier, an all-in-one WhatsApp marketing SaaS platform built...

Automotive

SectionTesla robotaxi trials begin in Austin

NEW YORK CITY, New York: Elon Musk is taking a big step toward making his long-promised robotaxi dream a reality. Over the weekend,...

Jindal Steel Commissions First Galvanizing Line (CGL 1) at Angul Integrated Steel Complex

Jindal Steel & Power Limited New Delhi [India], June 30: Jindal Steel has successfully commissioned its first Continuous Galvanising...

(SP)AUSTRIA-INNSBRUCK-SPORT CLIMBING-IFSC WORLD CUP-MEN'S LEAD-FINAL

(250630) -- INNSBRUCK, June 30, 2025 (Xinhua) -- Alberto Gines Lopez of Spain competes during the men's lead final at the International...

Two-wheeler and tractor sales set to grow, but cars and trucks may see slower growth between FY25-27: Report

New Delhi [India], June 30 (ANI): The automotive sector is expected to perform well in the coming years, especially in the two-wheeler...

Column: When tariffs backfire: how U.S. tariff hikes are hurting the American economy

The United States' recent tariff hikes have had detrimental effects on its economy, including slowed growth, rising costs, business...

Economic Watch: Clock ticking on EU-U.S. trade talks as key divides remain

U.S. President Donald Trump's unpredictable trade policies -- marked by abrupt tariff hikes, temporary suspensions and renewed threats...