Euro, pound surge as U.S. rate cut odds grow after Powell hint

Anabelle Colaco

29 Jun 2025, 05:06 GMT+10

- The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and Swiss franc, as markets ramped up bets that the Federal Reserve will cut interest rates sooner—and more aggressively—than previously expected

- The decline followed Fed Chair Jerome Powell’s comments to Congress this week, which investors interpreted as dovish

- Powell repeated that inflation could rise this summer but noted that “we will get to a place where we cut rates sooner than later” if price pressures remain contained

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and Swiss franc, as markets ramped up bets that the Federal Reserve will cut interest rates sooner—and more aggressively—than previously expected.

The decline followed Fed Chair Jerome Powell's comments to Congress this week, which investors interpreted as dovish. Powell repeated that inflation could rise this summer but noted that "we will get to a place where we cut rates sooner than later" if price pressures remain contained.

That tone opened the door to a potential rate cut as early as July, according to traders and analysts.

"This week it's definitely been about the Fed," said Eric Theoret, FX strategist at Scotiabank. "The prospect of easing sooner and potentially more rate cuts" is driving the current selloff in the dollar, he said.

Noel Dixon of State Street Global Markets added: "Powell kind of opened the door to potentially a July cut. If the next CPI release is below market expectations, I think markets will start to price in the probability of a cut to July."

As of Friday, Fed funds futures showed a 23 percent probability of a July rate cut, up from 13 percent just a week ago. The likelihood of a cut by September now stands at 93 percent. Traders are currently pricing in 66 basis points of easing by year-end—indicating a potential third 25-basis point move, up from 46 basis points last Friday.

Adding to the pressure on the dollar, President Donald Trump said he plans to nominate a new Fed Chair once Powell's term ends in May 2026. Trump, who has long criticised Powell, said this week that he has "three or four" potential replacements in mind and could name one by September or October. The Wall Street Journal reported that the choice could act as a "shadow Fed Chair," potentially undermining Powell's influence.

"That could be a problem if inflation reaccelerates," said Dixon. "The message there would be that they would discount the inflation."

However, Chicago Fed President Austan Goolsbee pushed back on that idea, stating that any replacement named before confirmation "would have no influence on monetary policy."

This week In forex markets, the euro rose 0.51 percent to US$1.1719, reaching as high as $1.1744—its strongest level since September 2021. The British pound climbed 0.62 percent to $1.3748, touching $1.3770, the highest since October 2021. The Swiss franc surged to 0.799 per dollar, a 10.5-year high. The dollar slipped 0.72 percent to 144.2 yen.

Beyond the Fed, investors are watching two other key U.S. deadlines: a July 9 target for avoiding new trade tariffs, and a July 4 Senate goal for passing a tax and spending bill. That legislation, if passed, could boost growth and potentially support the dollar.

But for now, structural concerns remain. "The budget and current account deficits are negative for the dollar," Dixon said.

Longer term, a reallocation of international capital away from U.S. assets could also weigh on the currency. "You've got a lot of asset managers that are long the U.S. dollar way more than I think they're comfortable," said Theoret.

In crypto markets, bitcoin dipped 0.43 percent to $107,382.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Manufacturing Mirror news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Manufacturing Mirror.

More InformationSmall Business

SectionUP: CM Yogi Adityanath pays tribute to philanthropist, Bhamashah; honors top tax-paying traders

Lucknow (Uttar Pradesh) [India], June 28 (ANI): Chief Minister Yogi Adityanath paid tribute to philanthropist and businessman Bhamashah...

WANotifier Joins TinySeed EMEA Fall 2024 Batch to Help Businesses Market at Scale on WhatsApp

SMPL Dover (Delaware) [US]/ Pune (Maharashtra) [India], June 28: WANotifier, an all-in-one WhatsApp marketing SaaS platform built...

Union Minister Piyush Goyal meets MSME stakeholders for implementation of Quality Control Orders

New Delhi [India], June 27 (ANI): Union Minister for Commerce and Industry Piyush Goyal held a stakeholder consultation meeting with...

Russia will not bend under sanctions finance minister

Responsible fiscal policies and strategic resource management have kept the country self-sufficient, Anton Siluanov has said Russia...

Russia will not bend under sanctions finance minister

Responsible fiscal policies and strategic resource management have kept the country self-sufficient, Anton Siluanov says Russia has...

On MSME Day, small business owners urge Govt for better tech, funding, skilled workforce

By Nikhil Dedha New Delhi [India], June 27 (ANI): On this MSME Day, entrepreneurs and small business founders across various sectors...

Automotive

SectionTesla robotaxi trials begin in Austin

NEW YORK CITY, New York: Elon Musk is taking a big step toward making his long-promised robotaxi dream a reality. Over the weekend,...

Toyota hikes US auto prices, says move is not tariff-driven

PLANO, Texas: Toyota Motor will raise prices across a range of vehicles in the United States starting next month, the Japanese automaker...

Markets rally on hopes Iran won’t disrupt oil flow

NEW YORK CITY, New York: U.S. stocks went up and oil prices fell this week as investors hoped that Iran would not block the global...

Economic Watch: Clock ticking on EU-U.S. trade talks as key divides remain

U.S. President Donald Trump's unpredictable trade policies -- marked by abrupt tariff hikes, temporary suspensions and renewed threats...

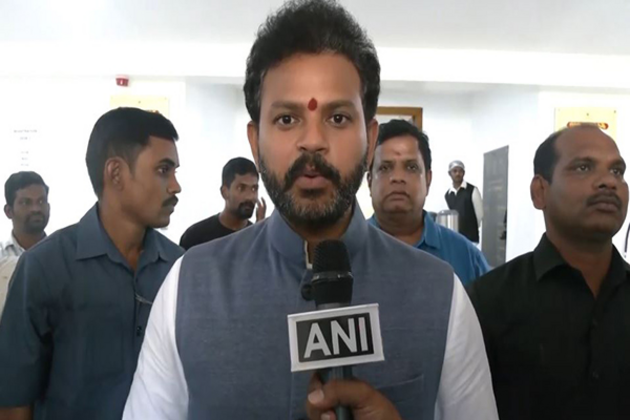

"Double engine sarkar is truly delivering for Andhra": Union Civil Aviation Minister Ram Mohan Naidu on revival of Vizag Steel Plant

New Delhi [India], June 28 (ANI): Union Civil Aviation Minister Ram Mohan Naidu on Saturday expressed his happiness over the revival...

"Indian skilled manpower is in great demand across world": Maharashtra Governor CP Radhakrishnan

Pune (Maharashtra) [India], June 28 (ANI): Maharashtra Governor CP Radhakrishnan on Friday said that the consistent effort, dedication,...