Why sovereign wealth funds find sweet spot in China

Xinhua

13 Sep 2021, 21:35 GMT+10

BEIJING, Sept. 13 (Xinhua) -- At a time when uncertainty has gripped the investment world, global sovereign wealth funds are looking at China for greater certainty in returns.

Chinese assets are becoming increasingly attractive to sovereign wealth funds, thanks to the country's impressive economic growth, higher asset returns and improved investment access, according to a recent study by investment management firm Invesco.

The firm surveyed 141 senior investment officers or portfolio strategists from 82 sovereign wealth funds and 59 central banks, and found that 98 percent of the funds are willing to maintain or increase their China allocations over the next five years.

"With China's growing economic standing and the potential attractive returns available on the mainland, it seems likely China will be top of mind for years to come," the report said.

In fact, some of the biggest sovereign wealth funds are already casting their vote of confidence in the world's second-largest economy.

By the end of June, China accounted for 4.9 percent of the equity investments of Norway Government Pension Fund Global, making it the single largest emerging market of the large-scale sovereign wealth fund.

Chinese assets accounted for 27 percent of the portfolios of Singapore-based Temasek Holdings by the end of March, more than the share of any other country.

What's behind the increased exposure to Chinese assets is the prospects of attractive returns. Major stock indices performed particularly well in 2020, helping the Norway Government Pension Fund Global secure a return of 33.9 percent in its Chinese equity investments.

Bond yield is also appealing. The 10-year treasury bond yield in China stood at around 2.9 percent, more than double that in the United States and much higher than the negative returns in the eurozone.

"The returns from the Chinese market have become the key to growth for major sovereign wealth funds," said Fu Chenggang, chief economist with the International Financial Center Federation.

A more important factor behind the increased investment in China by sovereign wealth funds is the country's economic resilience.

Usually funded by foreign exchange reserves and a country's budgetary surplus, sovereign wealth funds are often state-owned and are tasked with generating returns to help stabilize the economy and accumulate wealth for future generations.

With such objectives, the funds usually have a long-term investment horizon and seek stable returns. The Chinese economy, which proved resilient despite the COVID-19 impact, makes it a compelling investment case, said Arnab Das, a global market strategist with Invesco.

The Invesco report also cited China's increased openness to foreign investment in sectors such as infrastructure as the reason behind their bullishness.

"China's opening-up measures in the capital market, foreign trade and certain industries not only fuel the long-term growth momentum for the economy but offer more stable expectations for foreign investors," Fu said.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Manufacturing Mirror news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Manufacturing Mirror.

More InformationSmall Business

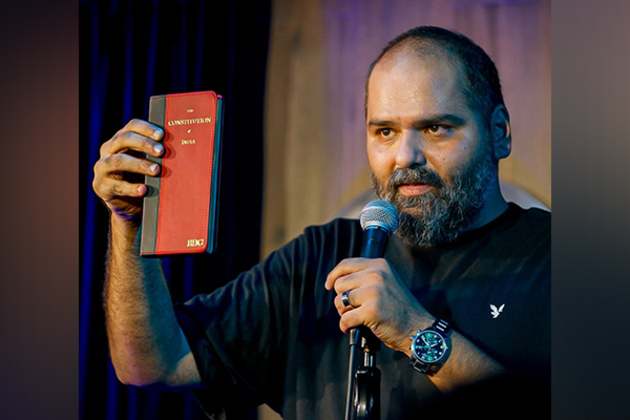

SectionUBT Sena's Sanjay Raut demands special protection for Kunal Kamra

Mumbai (Maharashtra) [India], March 29 (ANI): Shiv Sena (UBT) leader Sanjay Raut demanded special protection for satirist Kunal Kamra...

Nepal's former PM Dahal accuses former King of inciting violence, urges govt to take actions

By Binod Adhikari Kathmandu [Nepal], March 29 (ANI): Nepal's former Prime Minister Pushpa Kamal Dahal has accused former King Gyanendra...

More trouble for Kunal Kamra, three cases filed against him in Mumbai

Mumbai (Maharashtra) [India], March 29 (ANI): Three separate cases have been filed against Stand-up comedian Kunal Kamra at Khar police...

2 die in Nepal's pro-monarchy protest, curfew imposed

By Binod Prasad Adhikari Kathmandu [Nepal], March 28 (ANI): Two people, one protestor and a media person lost their lives in Friday's...

Xinhua Headlines: White paper highlights historic human rights progress in Xizang

(250328) -- LHASA, March 28, 2025 (Xinhua) -- A businessman from Nepal showcases products to customers at an import commodity fair...

Nepal: Pro-monarchy protestors clash with police in Kathmandu

Kathmandu [Nepal], March 28 (ANI): Violence broke out in Kathmandu on Friday after protesters calling for the restoration of monarchy...

Automotive

SectionWaymo gears up for driverless expansion in Washington, D.C.

WASHINGTON, D.C.: Alphabet's self-driving division Waymo is preparing to expand its driverless ride-hailing footprint to the heart...

Segway recalls 220,000 scooters over fall hazard

NEW YORK CITY, New York: Segway is recalling about 220,000 scooters in the U.S. because of a safety issue that can cause riders to...

Automakers lead U.S. stock markets lower after tariff hit

NEW YORK, New York - Shares in automakers fell sharply Thursday after U.S.President Donald Trump imposed a 25 percent tariff on all...

Ford F-150 under investigation for transmission defects

WASHINGTON, D.C.: Federal safety regulators have launched a new investigation into Ford's best-selling F-150 pickup trucks after receiving...

Hyundai to invest $20 billion in US, build steel plant in Louisiana

WASHINGTON, D.C.:/SEOUL: Hyundai Motor Group is set to dramatically expand its U.S. footprint, with a US$20 billion investment that...

China's EV advances drive new opportunities for Egypt's auto sector, industry leader says

Workers are seen at a factory of Egypt's Geyushi Automotive Industry in Sharqia Province, Egypt, on March 10, 2025. (Xinhua/Ahmed Gomaa)...